7 Proven Ways to Capture Every Dollar in Your Dental Practice

Every dollar you earn in your dental practice matters --- but most offices never collect it all. Here's how to change that.

📚 Part of our reconciliation series: This article is part of The Complete Guide to Dental Practice Reconciliation, our comprehensive resource on closing your books accurately and preventing revenue leakage.

Why 100% Revenue Capture Is Possible (and Why Most Practices Miss It)

Most dental practices think collecting 90--95% of production is "good enough."

In reality, that means thousands --- sometimes hundreds of thousands --- of dollars slip away each year.

The truth is:

Missed charges,

Claim denials, and

Uncollected patient balances

... quietly erode revenue month after month.

With the right processes, technology, and team habits, it's possible to consistently collect nearly 100% of what you produce --- without working longer hours or taking on more patients.

Common Sources of Revenue Leakage

1. Insurance Claim Denials & Underpayments

Coding mistakes, missing attachments, or filing delays are the biggest culprits.

Every denied or short-paid claim directly cuts into your collections.

2. Uncollected Patient Balances

If patients leave without paying their portion --- and no one follows up --- that money is unlikely to ever return.

3. Missed Charges & Billing Errors

Sometimes procedures never make it onto the claim. Other times, the wrong fee schedule is applied. Both result in lost income.

4. Cancellations & No-Shows

Empty chair time is unrecoverable revenue. While not a "billing" issue, it directly impacts monthly production.

Strategies to Capture 100% of Your Revenue

Optimize Insurance Collections

Verify coverage and eligibility before the appointment.

Submit all claims within 24 hours of treatment.

Attach all required documentation upfront (x-rays, perio charts, narratives).

Track claims weekly and follow up on any over 30 days.

Strengthen Patient Payment Processes

Present treatment costs and expected out-of-pocket before treatment begins.

Collect co-pays and deductibles at the time of service.

Offer payment plans or financing for larger cases.

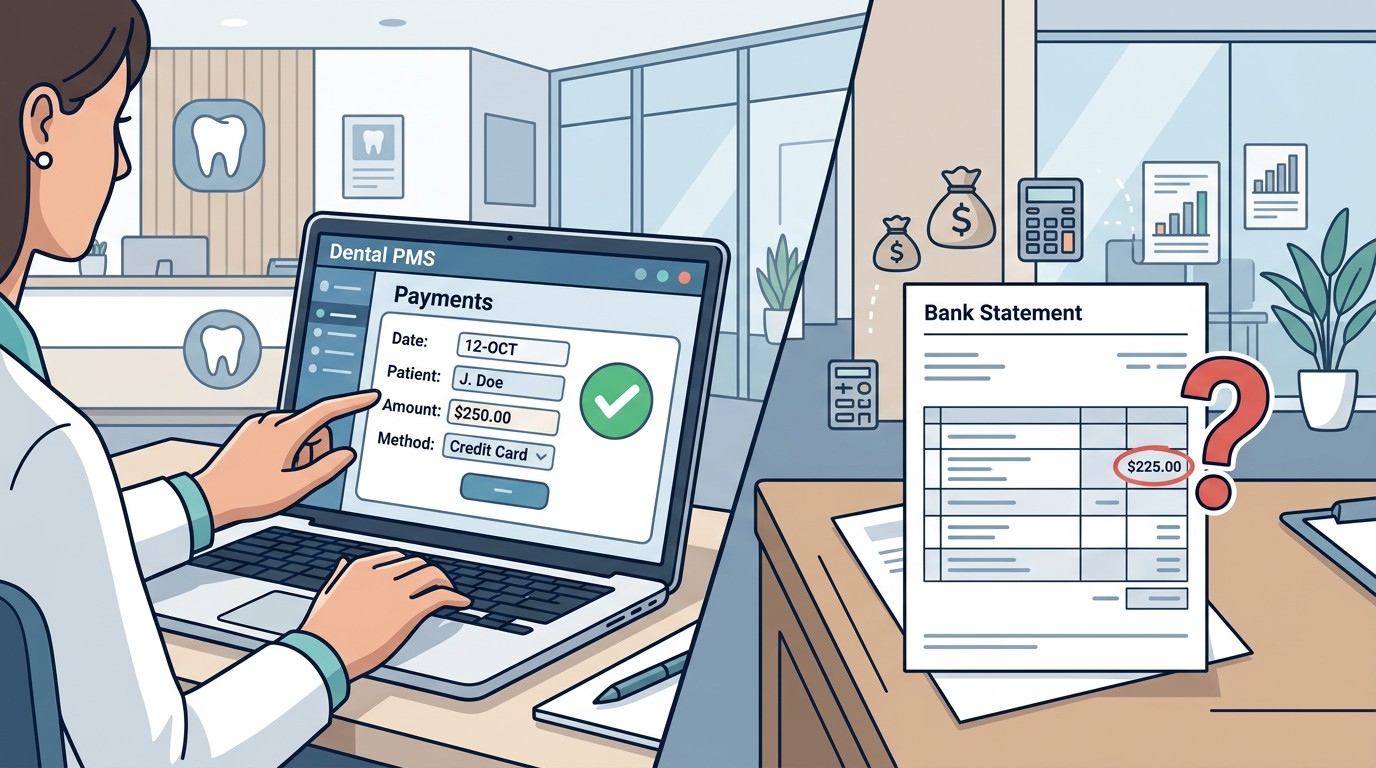

Audit and Reconcile Regularly

Compare billed procedures against completed treatments daily.

Review EOBs for underpayments or downgrades.

Investigate write-offs and adjustments to confirm they're valid.

Leverage Technology & Automation

Modern tools can flag missing charges, track claim statuses, and alert you to payment discrepancies automatically --- reducing the burden on your team.

Train and Empower Your Team

Financial processes are only as strong as the people running them.

Hold regular training on coding, insurance, and collections best practices.

Metrics to Monitor

Track these KPIs monthly to spot revenue issues early:

Net collection percentage (target: 98%+)

Claim denial rate (keep under 5%)

Accounts receivable aging (minimal over 90 days)

Production vs. collections gap

The Payoff of Full Revenue Capture

Reaching 100% collections isn't just about numbers.

It means:

More funds for new equipment and technology

Better compensation for your team

Greater financial stability for the practice

And perhaps most importantly --- it ensures the work you do is fairly compensated.

Ready to stop revenue leakage in your practice? Zeldent's intelligent monitoring catches billing errors and missed collections before they impact your bottom line. Schedule a demo to see how much revenue you could be recovering.